|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Home Loan After 6 Months: A Comprehensive GuideRefinancing your home loan after just six months might seem quick, but it can be a strategic move under the right circumstances. This guide explores when and why you might consider refinancing shortly after your initial loan. Why Consider Refinancing So Soon?There are several reasons homeowners might choose to refinance their mortgage after just six months. Understanding these can help determine if it's the right choice for you. Interest Rate ChangesIf interest rates have dropped since you secured your loan, refinancing could reduce your monthly payments significantly. Lower rates can lead to substantial savings over the life of the loan. Improved Credit ScorePerhaps your credit score has improved since you first took out your mortgage. A higher credit score may qualify you for better rates and terms, making refinancing an attractive option.

Understanding the Costs InvolvedRefinancing isn't free, and understanding the refi closing costs is crucial before deciding. Typical Refinancing Costs

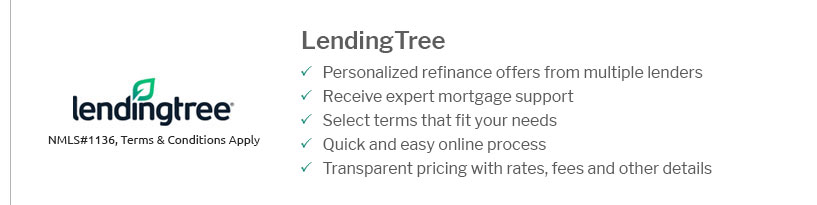

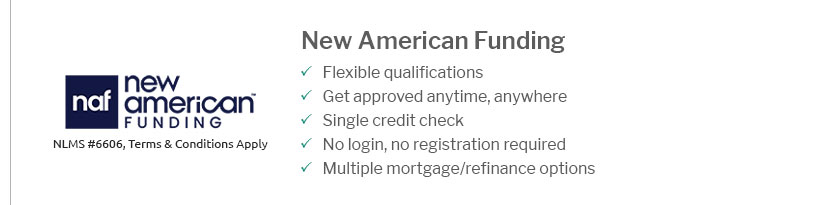

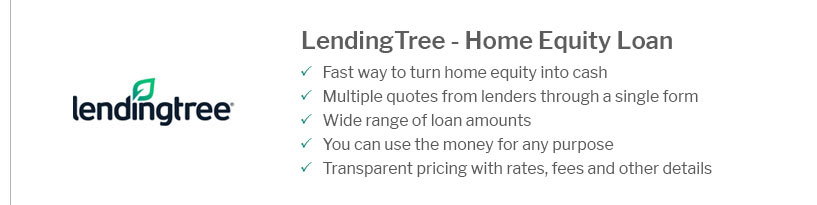

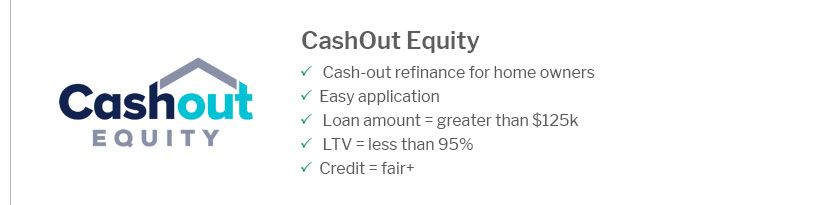

These costs can add up, so it's important to calculate whether refinancing will truly save you money in the long run. Steps to Refinance Your Home LoanRefinancing your home loan involves several steps, each requiring careful consideration and planning. Evaluate Your Current LoanStart by reviewing your current loan terms and assessing your financial situation. Understanding where you stand will help you make informed decisions. Research LendersNext, research potential lenders. Look for competitive rates and terms that fit your needs. This process is similar to the initial mortgage application. For more detailed guidance, visit how to refinance a home loan. Apply for the LoanOnce you've chosen a lender, you'll need to submit your application. Be prepared to provide documentation of your income, assets, and current loan details. FAQ SectionCan I refinance my home loan if I have a bad credit score?Refinancing with a bad credit score is possible, but it might result in higher interest rates. Consider improving your score before refinancing to secure better terms. How soon can I refinance after purchasing a home?While technically you can refinance immediately, most lenders recommend waiting at least six months to establish your financial stability and increase your chances of favorable terms. Will refinancing affect my credit score?Refinancing can temporarily lower your credit score due to the hard inquiry on your report. However, responsible credit management can help recover and even improve your score over time. In conclusion, refinancing your home loan after six months can be beneficial under the right circumstances. Evaluate your financial situation, understand the costs involved, and proceed with a clear strategy to make the most of this financial move. https://money.stackexchange.com/questions/87467/refinancing-immediately-after-closing-on-a-house-purchase

Loan officers can and do pay a penalty is a loan is refinanced within 6 months after closing, it's called an EPO penalty ("Early pay off") and every lending ... https://www.reddit.com/r/Mortgages/comments/1fkog34/lender_told_me_i_cant_refinance_because_i_have_to/

6-Month Rule: Some lenders or investors in the mortgage (like Fannie Mae or Freddie Mac) require a 6-month waiting period after your loan is ... https://ficoforums.myfico.com/t5/Mortgage-Loans/Better-to-refinance-in-six-months-or-wait-a-year/td-p/6756857

If you want a lower rate and less total interest payments, consider a 15 year loan vs 30 year when refinancing. Fico 9: .......EQ 850 TU 850 EX ...

|

|---|